The smart Trick of Business Debt Collection That Nobody is Discussing

Wiki Article

All about Business Debt Collection

Table of ContentsGetting The Personal Debt Collection To WorkSome Ideas on Debt Collection Agency You Need To KnowThe Definitive Guide for Business Debt Collection5 Simple Techniques For Business Debt Collection

The financial obligation buyer gets just a digital file of information, frequently without sustaining proof of the financial obligation. The debt is likewise usually very old debt, sometimes referred to as "zombie financial debt" due to the fact that the financial obligation customer attempts to revive a financial debt that was beyond the statute of restrictions for collections. Financial obligation debt collection agency might contact you either in creating or by phone.

However not speaking to them won't make the debt disappear, and they may simply try alternative approaches to contact you, including suing you. When a financial obligation enthusiast calls you, it is very important to obtain some first info from them, such as: The financial obligation collector's name, address, and also contact number. The overall amount of the financial debt they assert you owe, including any type of charges as well as passion costs that might have accrued.

3 Simple Techniques For Personal Debt Collection

The letter has to specify that it's from a financial debt collection agency. Name and deal with of both the financial debt collector and also the borrower. The creditor or creditors to whom the financial debt is owed. An itemization of the financial obligation, including charges and rate of interest. They should also inform you of your civil liberties in the financial obligation collection procedure, as well as how you can contest the financial obligation.If you do challenge the financial obligation within thirty day, they must stop collection initiatives until they provide you with proof that the financial obligation is your own. They must supply you with the name as well as address of the original creditor if you request that information within 30 days. The financial debt validation notification must consist of a kind that can be used to contact them if you want to challenge the financial debt.

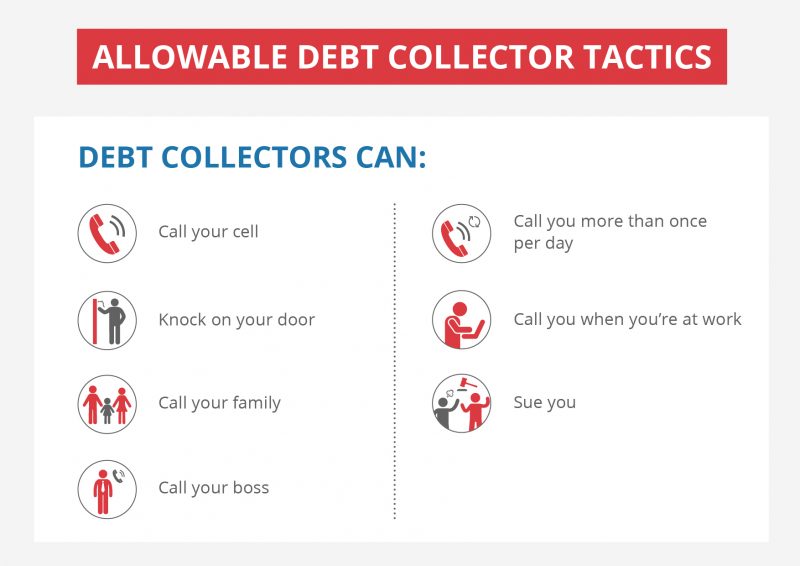

Some things financial debt collection agencies can not do are: Make repeated calls to a borrower, planning to frustrate the debtor. Usually, unpaid financial obligation is reported to the debt bureaus when it's 30 days past due.

If your debt is transferred to a debt enthusiast or marketed to a debt purchaser, an entrance will be made on your credit report. Each time your financial debt is sold, if it continues to go unpaid, an additional entry will certainly visit be contributed to your credit report. Each unfavorable entry on your credit score record can remain there for approximately seven years, also after the financial obligation has actually been paid.

The Main Principles Of Debt Collection Agency

What visit this site right here should you anticipate from a collection company as well as how does the process work? When you have actually made the decision to hire a collection firm, make sure you select the ideal one.Some are better at getting results from bigger organizations, while others are experienced at collecting from home-based organizations. See to it you're dealing with a business that will actually serve your requirements. This may seem noticeable, yet prior to you work with a debt collection agency, you require to make sure that they are qualified and also licensed to act as financial debt collection agencies.

Before you begin your search, comprehend the licensing demands for debt collection agency in your state. That method, when you are speaking with agencies, you can speak intelligently regarding your state's needs. Check with the companies you talk to to ensure they satisfy the licensing requirements for your state, particularly if they lie in other places.

You should additionally examine with your Better Company Bureau and also the Industrial Debt Collection Agency Association for the names of reliable as well as very pertained to financial debt collectors. While you might be passing along these financial debts to a collector, they are still representing your company. You require to know just how they will certainly represent you, just how they will function with you, and also what relevant experience they have.

Business Debt Collection Fundamentals Explained

Simply because a strategy is legal doesn't mean that it's something you desire your business name related to. A reliable financial obligation enthusiast will certainly collaborate with you to lay out a plan you can cope with, one that treats your previous clients the means you 'd wish to be dealt with and also still obtains the job done.If that happens, one strategy numerous agencies use is skip mapping. You must likewise dig into the a knockout post enthusiast's experience. Pertinent experience increases the possibility that their collection initiatives will certainly be effective.

You should have a factor of call that you can interact with and get updates from. Business Debt Collection. They need to be able to plainly articulate what will be anticipated from you while doing so, what information you'll require to give, and also what the cadence and activates for communication will certainly be. Your selected company ought to be able to suit your selected interaction demands, not compel you to approve their own

Despite whether you win such a situation or otherwise, you wish to be sure that your firm is not the one on the hook. Ask for proof of insurance from any type of collection firm to shield on your own. This is most commonly called an errors and noninclusions insurance coverage. Debt collection is a solution, and it's not an economical one.

Report this wiki page